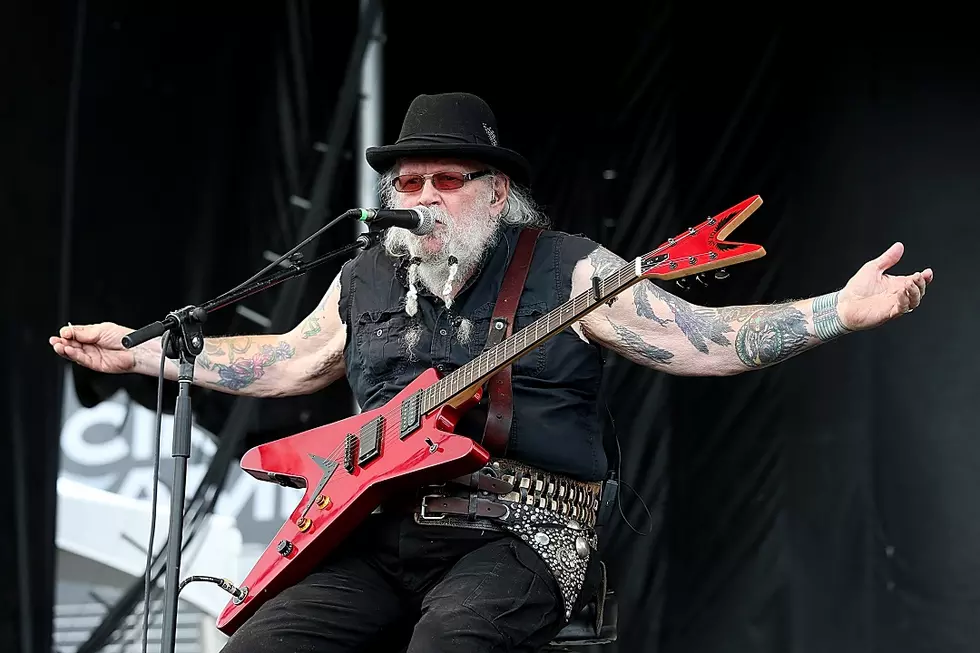

David Allan Coe Charged With Income Tax Evasion, Pleads Guilty

Singer-songwriter David Allan Coe has pleaded guilty to one count of obstructing the due administration of the IRS (aka, income tax evasion). According to officials, he owes the IRS more than $466,000 in taxes from as far back as 1993.

The nearly-half-million-dollar sum includes taxes owed -- plus interest and penalties -- between 2008 and 2013, when Coe either did not file his income tax returns or did not pay the taxes owed, according to the Cincinnati Enquirer; much of the owed money is from the 2009 tax year, WLWT-TV reports. Instead of paying his taxes, the U.S. Attorney's Office says that Coe covered gambling and other debts.

The 76-year-old performs approximately 100 concerts per year, and he is paid in cash for each show -- an arrangement that, according to a news release, "was also in an effort to impede the ability of the IRS to collect on the taxes owed." Coe's manager would pick up the money, pay himself and the band, and then give the remaining money to the country artist.

However, according to the news release, Coe would not accept $50 bills because "he believed they were bad luck and would not gamble with them."

WLWT reports that, in May of 2009, after hearing from the IRS about his then-current tax liabilities, Coe stopped using his personal bank account.

Coe, who is best known for his song "Take This Job and Shove It," entered his plea in a U.S. District Court in Cincinnati, Ohio, on Monday (Sept. 14). He could face three years in prison plus a $250,000 fine.

Country Artists Who Have Suffered Hardships

More From TheBoot

![‘American Idol': Gospel Singer Dontrell Briggs’ Moving ‘Tennessee Whiskey’ Cover Wins Luke Bryan Over [Watch]](http://townsquare.media/site/204/files/2022/03/attachment-Screen-Shot-2022-03-14-at-8.26.23-AM.jpg?w=980&q=75)